Equiti Securities and Commodities Group

Introduction to Equiti's Trading Services in Egypt

Equiti Group Limited provides Egyptian traders access to global financial markets through its advanced trading infrastructure. Operating since 2008, the company maintains strict regulatory compliance under the Jordan Securities Commission (JSC). Egyptian traders benefit from institutional-grade liquidity pools, with trades executed through state-of-the-art data centers in London and New York. The company processes over 20,000 trades daily across its global network, maintaining 99.9% platform uptime throughout the trading week.

Trading Products Available to Egyptian Clients:

- Forex pairs: 60+ currency combinations

- Commodities: Gold, Silver, Oil, Natural Gas

- Stock indices: 15 major global indices

- Individual shares: 2000+ global stocks

- ETFs: 50+ exchange-traded funds

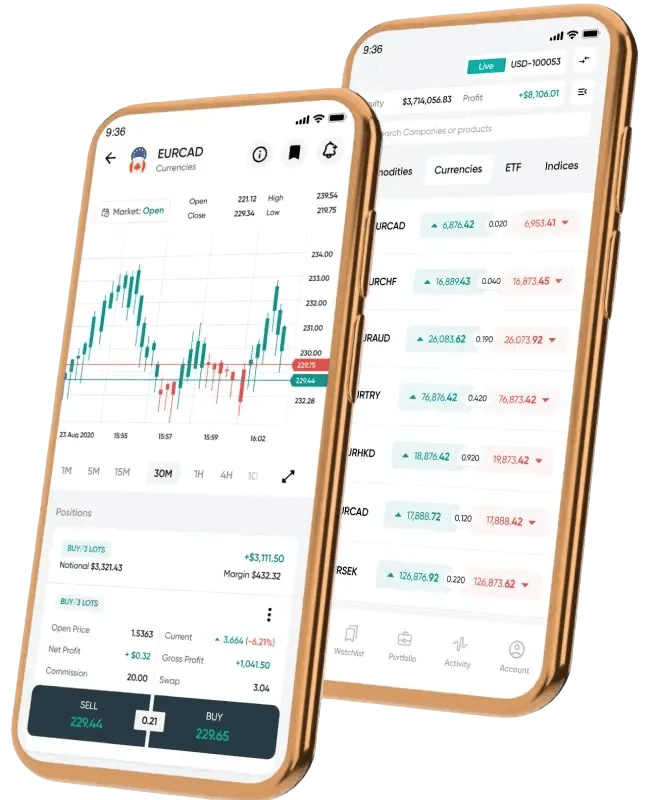

Account Types and Trading Conditions

Egyptian traders can choose between two main account categories tailored to different trading styles and experience levels. The Standard Account requires no minimum deposit and offers commission-free trading with average spreads of 1.4 pips on major pairs. For more active traders, the Premier Account starts from $3,000 and provides raw spreads from 0.0 pips with a commission of $3.5 per lot per side. Both accounts feature margin requirements starting from 1% and leverage up to 1:400 on major currency pairs.

Standard Account Specifications

- Zero commission structure

- Average EURUSD spread: 1.4 pips

- Minimum trade size: 0.01 lots

- Maximum position size: 300 lots

- Order execution speed: <12ms

- Swap-free options available

- Multi-currency support

Trading Platform Comparison:

| Feature | MT4 | MT5 | Equiti Trader |

| Time frames | 9 | 21 | 12 |

| Indicators | 30 | 38 | 25 |

| EAs support | Yes | Yes | No |

| Mobile version | Yes | Yes | Native app |

| Chart types | 3 | 5 | 4 |

Advanced Trading Technology Infrastructure

Equiti’s technology stack incorporates multiple price feeds from tier-1 liquidity providers, ensuring competitive pricing and deep market depth. The infrastructure includes redundant data centers with cross-connected fiber optic networks, maintaining latency under 12 milliseconds. Trade execution occurs through dedicated servers equipped with enterprise-grade hardware, processing over 500 price updates per second.

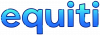

Trading Platform Features

The company provides three main trading platforms optimized for Egyptian traders. MetaTrader 4 and 5 offer advanced charting capabilities with multiple timeframes and over 80 built-in indicators. The proprietary Equiti Trader mobile app delivers full trading functionality with TradingView charts integration and real-time market updates.

Supported Trading Tools:

- Custom indicators development

- Automated trading systems

- Advanced charting packages

- Risk management tools

- Market depth analysis

- Economic calendar

- Trading signals

Security and Fund Protection Measures

Client funds from Egypt are held in segregated accounts at major international banks including Barclays and JPMorgan Chase. The company implements 256-bit SSL encryption for all data transmission and maintains strict security protocols. Two-factor authentication is mandatory for all account operations, while real-time monitoring systems detect and prevent suspicious activities.

Market Analysis Tools Comparison:

| Tool Type | Standard Account | Premier Account |

| Technical indicators | 30 | 50 |

| News feeds | Basic | Premium |

| Trading signals | Limited | Unlimited |

| Market depth | Level 1 | Level 2 |

| Risk analytics | Basic | Advanced |

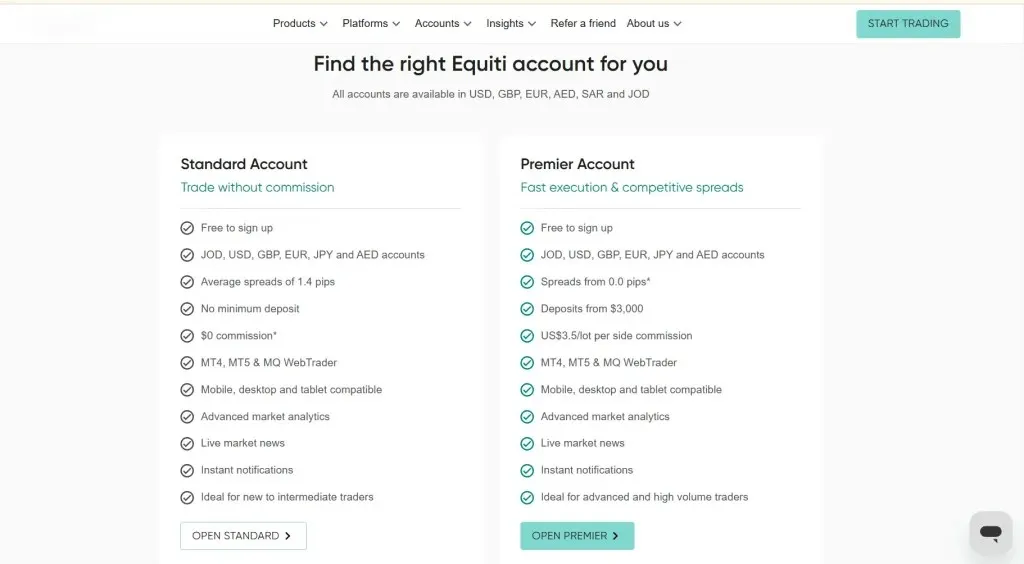

Educational Resources and Market Analysis

Equiti provides comprehensive educational materials specifically designed for Egyptian traders. This includes detailed video tutorials, webinars conducted in English, and regular market analysis reports. Technical analysis tools include pattern recognition algorithms and automated market scanners.

Market Analysis Features

Traders receive daily market insights covering major asset classes and potential trading opportunities. The analysis includes support/resistance levels, trend indicators, and volatility measurements. Premium account holders gain access to institutional-grade research tools and professional trading signals.

Commission Structure:

| Account Type | Spread From | Commission per Lot | Minimum Deposit |

| Standard | 1.4 pips | $0 | $0 |

| Premier | 0.0 pips | $3.5 | $3,000 |

| Islamic | 1.6 pips | $0 | $100 |

Payment Processing and Fund Management

Egyptian traders can utilize multiple payment methods including local bank transfers, international wire transfers, and major e-wallets. Deposits are processed instantly while withdrawals are completed within 24 hours for e-wallets and 2-3 business days for bank transfers. The minimum withdrawal amount stands at $50 with no processing fees charged by Equiti.

Risk Management Tools and Trading Features

Equiti’s platform incorporates advanced risk management capabilities designed for Egyptian market conditions. The system allows setting multiple take-profit and stop-loss levels per position, with trailing stop functionality. Position sizing calculators help traders maintain optimal risk levels, while margin calls are automatically triggered at 50% to prevent account liquidation. Real-time equity monitoring provides instant notifications when predefined risk thresholds are reached.

Automated Trading Capabilities

Egyptian traders can implement automated strategies through Expert Advisors (EAs) and custom indicators. The platform supports MQL4/MQL5 programming languages, allowing creation of personalized trading algorithms. Backtesting engines process historical data with tick-level precision, enabling strategy optimization across multiple timeframes.

FAQ:

Standard Accounts have no minimum deposit requirement, while Premier Accounts require an initial deposit of $3,000.

E-wallet withdrawals are processed within 24 hours, while bank transfers typically take 2-3 business days to complete.

Indian traders can access MetaTrader 4, MetaTrader 5, and the proprietary Equiti Trader mobile app.